2020年12月船舶拍卖市场评述

12月,临近年末,部分基建项目进入最后的冲刺,工业用电量增长,加上东南沿海气温骤降,民用电快速增加,国内煤炭供应紧张,煤矿检修停产或减量生产,开工率持续下降,保供压力加大,进口煤补充存在不确定性,导致浙江、湖南等地电力供应出现不足。海运市场行情大幅上涨,沿海散货运价高位波动,船舶拍卖市场行情较上月进一步回升。本月中国船舶拍卖市场累计拍卖94艘次,成交54艘次,成交率57.4%,起拍价累计约31038万人民币,成交额累计26797万人民币,各项拍卖数据较上月显著提升。

一、沿海运价大幅提振,船舶拍卖市场热情上涨

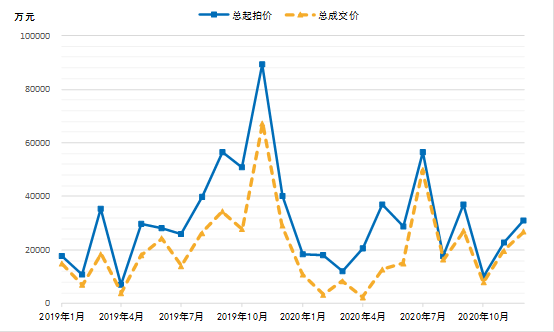

寒潮席卷全国,气温明显下降,煤炭等大宗货物需求明显提升,下游采购热情上涨,一度出现运力紧张局面,沿海散货运输市场运价大涨。根据拍船网(www.shipbid.net)统计数据[1],12月,中国船舶拍卖市场累计拍卖94艘次,环比增加25艘次,同比增加53艘次。其中,干散货类船舶拍卖34艘次,环比增加15艘次,液货类船舶拍卖5艘次,环比增加2艘次。成交率方面,本月累计成交54艘次,环比增加21艘次,成交率为57.4%,成交率环比有所提升。

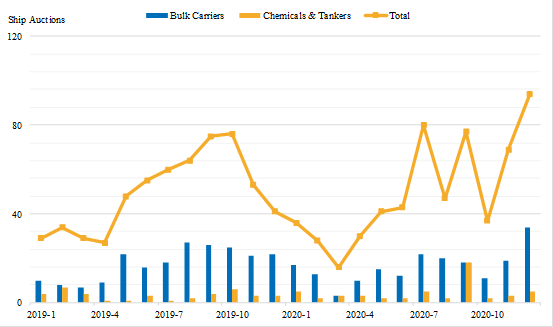

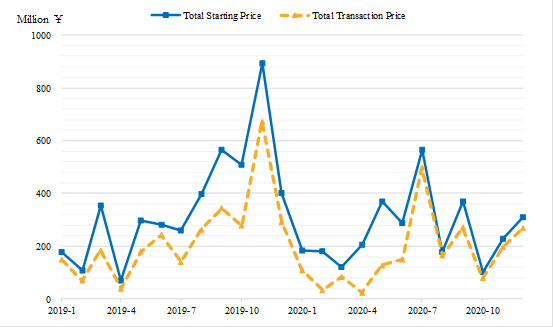

拍卖金额环比继续增长。12月,中国船舶拍卖市场起拍价累计约31038万人民币,环比增加8336万人民币,同比减少9170万人民币;成交额累计26797万人民币,环比增加7117万人民币,同比减少2263万人民币。

图1 中国船舶拍卖市场拍卖艘次情况

图2 中国船舶拍卖市场拍卖金额情况

二、海上基建提速,工程类船舶需求火热

各地大力推进港口建设,浙江省加快海洋经济和港口经济“一体化、协同化”发展的重大决策部署,迈向世界级港口集群,粤港澳大湾区建设提速,广深珠三大港口基地建设如火如荼,工程类船舶需求火爆,挖泥船、拖轮等船舶拍卖溢价率较高。“港兴拖201”“舟港拖3”两艘拖轮拍卖溢价率分别达368.8%和444.4%,“深浚18”挖泥船拍卖溢价率达99.1%。

司法拍卖方面,本月拍卖船舶80艘次,成交42艘次,成交率52.5%,起拍价总额30684万元,成交总额25654万元,受工程船行情带动,较上月成交情况明显改善;商业拍卖方面,本月拍卖船舶14艘次,成交12艘次,成交率85.7%,起拍价总额393万元,成交总额1159万元,商拍成交率高位波动,成交情况较好。

重点船舶拍卖情况,干散货船舶方面,“sam lion”5.8万载重吨散货船以6783.6万元成交,溢价率19.7%。油运船舶方面,“神州3529”5631载重吨内河油船以1508万元成交,“光汇328”4261载重吨无限航区油船以3900万元成交。其他船型方面,工程类船舶成交17艘次,成交量远超上月,客滚类船舶成交8艘次,渔业用船成交2艘次。

「拍卖成交船舶案例」

|

干散货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

sam lion

|

无限

|

57539.8

|

2012

|

韩国

|

¥5665.6

|

¥6783.6

|

44

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

神州3529

|

内河

|

5631

|

2014

|

重庆

|

¥1128

|

¥1508

|

20

|

|

2

|

光汇328

|

无限

|

4261

|

2016

|

山东

|

¥3900

|

¥3900

|

1

|

|

工程类船舶

|

|

序号

|

船名

|

航区

|

载重量

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

舟港拖3

|

遮蔽

|

-

|

1980

|

日本

|

¥86.94

|

¥473.34

|

131

|

|

2

|

港兴拖201

|

遮蔽

|

-

|

1974

|

日本

|

¥90.72

|

¥425.32

|

160

|

「拍卖船舶预告」

|

干散类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

湘岳阳货1886

|

内河

|

4847

|

2006

|

湖南

|

¥700

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

海之星998

|

近海

|

10800

|

2013

|

浙江

|

¥3482.2

|

|

集装箱及多用途船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

金富星11

|

近海

|

7864

|

2004

|

浙江

|

¥1350

|

[1]数据来源于各大拍卖平台、产权交易所公开竞价平台、船舶交易所公开竞价平台等,或有少量现场拍卖因公开程度有限可能未纳入统计

monthly

analysis of ship auction market in china

december

2020

in december, the spring festival is approaching, and some

infrastructure projects are in the sprint stage. industrial electricity

consumption has increased, coupled with the increased residential electricity

consumption for sudden drop of temperature in the southeast area, made the

domestic coal supply tight. in addition, domestic coal mine have stopped or

reduced production for technical inspections, with the operating rate continued

to decline, the pressure of ensuring coal supply has increased. what’s more,

there is uncertainty in the replenishment of imported coal. all these factors have

led to the shortage of power supply in zhejiang, hunan and other provinces. recently,

the shipping market has risen sharply, freight rate of coastal bulk cargo have

fluctuated at a high level, and the ship auction market has rebounded further

from last month. this month, the ship auction market in china has seen a total

of 94 auctions and 54 transactions, with a transaction rate of 57.4%. the total

starting price is about ¥310.38m, while the total transaction price is ¥267.97m, with all data increased significantly from the previous

month.

the coastal freight rate boosts greatly, while the enthusiasm of

the ship auction market rises.

the

nationwide cold spell leads to a sharply drop in temperature which made a

significant increase in the demand for coal and other bulk goods. the enthusiasm

for downstream good purchase rises which results in shortage of transport

capacity and boost of freight rate of the coastal bulk cargo. according

to data from www.shipbid.net1, the total ship auctions of december

are 94, which increase 25 mom and 53 yoy. among them, the bulk carrier auctions

are 34, which increase 15 mom. the chemical & tanker auctions are 5, which

increase 2 mom. in terms of transaction, there are 54 ships traded, which increase

21 mom, with transaction rate of 57.4%, increasing slightly mom.

in december, the price of auction continues to increase from last

month. the total starting price is approximately ¥310.38m,

which increases ¥83.36m mom but decreases ¥91.70m yoy. the total

transaction price is ¥267.97m, which increases ¥71.17m mom but

decreases ¥22.63m yoy.

chart1 total of ship auctions in china

chart2

total price of ship auction in china

the speed of offshore infrastructure is accelerated, and the

demand for engineering ships is high.

the

port construction has promoted in all parts of country. zhejiang province

accelerates the major decisions and arrangements of “integration and

coordination” of marine economy and port economy to build a world-class port

cluster; the construction of the guangdong-hong kong-macao greater bay area

accelerated; the construction of the three major port bases in guangzhou, shenzhen

and zhuhai is in full swing. affected by the above projects, the demand for

engineering ships is booming, and the auction premium rate for dredgers and

tugs is relatively high recently. the premium rate of the two tugs “gang xing tuo

201” and “zhou gang tuo 3” are 368.8% and 444.4% respectively, and which of the

dredger “shenjun 18” reaches 99.1%.

in

terms of judicial auction, there are 80 ships auctioned in december, of which

42 ships are sold, with the transaction rate of 52.5%. the total starting price

is ¥306.84m, and the total transaction

price is ¥256.54m,

which improves significantly compared with last month driven by the engineering

ship market. in terms of commercial auctions, there are 14 ships auctioned, of

which 12 ships are sold, with the transaction rate of 85.7%. the total starting

price is ¥3.93m, the

total transaction price is ¥11.59m. the commercial auction transactions are good with transaction

rate fluctuating at a high level.

followed are

some specific auctions. in terms of bulk carriers, the 58,000dwt bulk carrier “sam

lion” is sold at ¥67.836m, with premium rate of

19.7%. in terms of tankers, the 5,631dwt

inland river oil tanker “shenzhou 3529” is sold at ¥15.08m. the 4,261dwt oil tanker

"guanghui 328" with unrestricted navigation is sold at ¥39.00m.

in terms of other ships, there are 17 engineering

ships traded which is far higher than last month. there are 8 passenger ships and 2 fishing ships traded in december.

samples of ship auctions

|

bulk carriers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

sam lion

|

unrestricted

navigation

|

57539.8

|

2012

|

korea

|

¥56.66m

|

¥67.84m

|

44

|

|

chemicals & tankers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

shenzhou 3529

|

inland river

|

5631

|

2014

|

chongqing

|

¥11.28m

|

¥15.08m

|

20

|

|

2

|

guanghui 328

|

unrestricted

navigation

|

4261

|

2016

|

shandong

|

¥39m

|

¥39m

|

1

|

|

engineering ships

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

zhougangtuo 3

|

sheltered

navigation

|

-

|

1980

|

japan

|

¥0.87m

|

¥4.73m

|

131

|

|

2

|

gangxingtuo

201

|

sheltered

navigation

|

-

|

1974

|

japan

|

¥0.91m

|

¥4.25m

|

160

|

preview of ship auctions

|

bulk carriers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

|

1

|

xiangyueyanghuo

1886

|

inland river

|

4847

|

2006

|

hunan

|

¥7m

|

|

chemicals & tankers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

|

1

|

haizhixing 998

|

coastal

|

10800

|

2013

|

zhejiang

|

¥34.82m

|

|

container & multi-purpose vessel

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

|

1

|

jinfuxing 11

|

coastal

|

7864

|

2004

|

zhejiang

|

¥13.5m

|