2020年11月船舶拍卖市场评述

9-11月间,中国出口、工业增加值恢复强劲,规模以上工业增加值同比实际增长均在6%以上,连续三个月高于去年同期值,同时零售增速加快,投资累计增速保持恢复。时至年底,又遇上欧美等国疫情反弹,海外制造业受阻,中国制造业出口供不应求。海运市场行情由弱转稳,伴随供暖季到来,船东挺价心态较强,运价止跌回升。船舶拍卖市场较上月明显回温,市场干散货船拍卖数量不多,工程类船舶拍卖热度火爆,本月中国船舶拍卖市场累计拍卖61艘次,成交33艘次,成交率54.1%,起拍价累计约12829万人民币,成交额累计8473万人民币,各项拍卖数据较上月均翻倍提升。

一、沿海运输需求升温,船舶拍卖市场热度延续

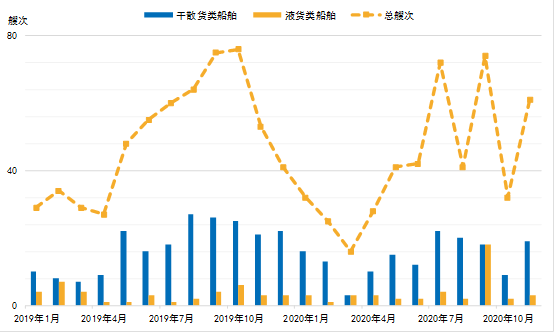

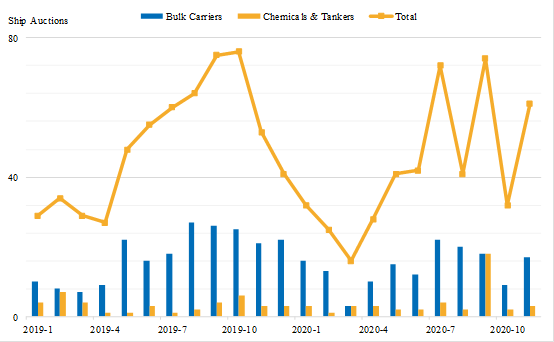

采暖季开启,煤炭运输需求快速提升,同时粮食出库增加,深加工企业原料冬储开始,干散货市场在多空博弈仍然较强的情况下止跌转升,干散货船舶需求较好,但拍卖市场内干散货类船舶项目不多。根据拍船网(www.shipbid.net)统计数据[1],11月,中国船舶拍卖市场累计拍卖61艘次,环比增加29艘次,同比增加8艘次。其中,干散货类船舶拍卖17艘次,环比增加8艘次,液货类船舶拍卖3艘次,环比增加1艘次。成交率方面,本月累计成交33艘次,环比增加16艘次,成交率为54.1%,成交率环比小幅提升。

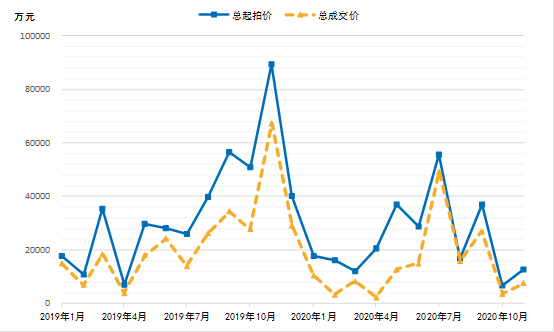

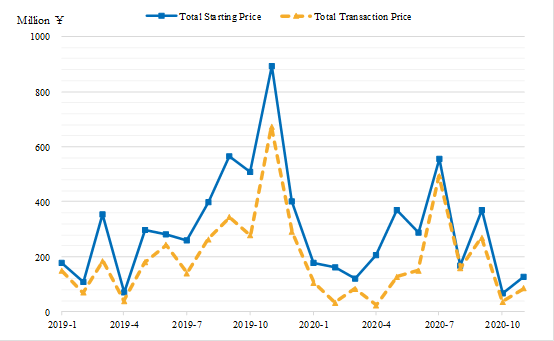

拍卖金额环比大幅增长。11月,中国船舶拍卖市场起拍价累计约12829万人民币,环比增加6026万人民币,同比减少76482万人民币;成交额累计8473万人民币,环比增加4872万人民币,同比减少58887万人民币。

图1 中国船舶拍卖市场拍卖艘次情况

图2 中国船舶拍卖市场拍卖金额情况

二、新基建新能源建设推进,工程类船舶需求火爆

今年3月,中央政治局常务委员会强调,加快推进国家规划已明确的重大工程和基础设施建设,“新基建”成为我国稳投资、稳增长、促消费,实现经济平稳有序发展的重要抓手。5g网络、工业互联网、物联网、数据中心等数字基建,以及风电、太阳能等清洁能源基建,为船舶交易带来了大量的工程类船舶需求,甲板货船等大件货运输船舶需求同样旺盛。“粤广州工0106”抓斗式挖泥船从32万拍至102.8万成交,“鑫辉6”、“鑫辉8”、“鑫辉18”运泥船均高价成交,其中“鑫辉18”溢价率达152.4%。

司法拍卖方面,本月拍卖船舶49艘次,成交23艘次,成交率46.9%,起拍价总额9172万元,成交总额4221万元,以渔船、工程船、内河干散货船为主;商业拍卖方面,本月拍卖船舶12艘次,成交10艘次,成交率83.3%,起拍价总额3657万元,成交总额4252万元,本月商拍除“新一海1”散货船和“绪扬6”成品油船成交外,另有多艘远洋渔船成交,成交情况较好。

重点船舶拍卖情况,干散货船舶方面,“新一海1”1.5万载重吨近海散货船二拍成交价超过一拍起拍价,以2742万元成交,溢价率30.5%。油运船舶方面,“绪扬6”3496载重吨成品油船以1062万元成交,“恒帆7”934载重吨成品油船以274.5万元成交。其他船型方面,工程类船舶成交4艘次,溢价率保持高位,客滚类船舶成交3艘次,渔业用船成交12艘次,较上月大幅提升。

「拍卖成交船舶案例」

|

干散货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

新一海1

|

近海

|

15157

|

2007

|

舟山

|

¥2100

|

¥2742

|

149

|

|

2

|

贵港宏驰23

|

内河

|

4000

|

2019

|

贵港

|

¥560

|

¥638

|

24

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

绪扬6

|

近海

|

3496

|

2001

|

宁波

|

¥800

|

¥1062

|

40

|

|

渔业用船

|

|

序号

|

船名

|

航区

|

载重量

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

金丰5

|

远洋

|

-

|

1984

|

日本

|

¥79

|

¥125

|

88

|

|

2

|

金丰6

|

远洋

|

-

|

1983

|

日本

|

¥92

|

¥146

|

75

|

|

3

|

顺昌3

|

远洋

|

-

|

1990

|

中国

台湾

|

¥78

|

¥135

|

36

|

|

工程类船舶

|

|

序号

|

船名

|

航区

|

载重量

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

粤广州工0106

|

内河

|

-

|

1994

|

台山

|

¥32

|

¥102.8

|

172

|

|

2

|

鑫辉18

|

沿海

|

1265

|

2010

|

宁波

|

¥135

|

¥340.69

|

132

|

「拍卖船舶预告」

|

干散类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

sam lion

|

远洋

|

57539.8

|

2012

|

韩国

|

¥5665.6

|

[1]数据来源于各大拍卖平台、产权交易所公开竞价平台、船舶交易所公开竞价平台等,或有少量现场拍卖因公开程度有限可能未纳入统计

monthly

analysis of ship auction market in china

november

2020

from september to november, china’s exports and industrial added

value recovers strongly. the added value of the industrial enterprises above

designated size is up by over 6% yoy, which is higher than that of the same

period last yearfor three consecutive months. meanwhile, the growth rate of retail

industry accelerates, and the cumulative growth rate of investment continues to

recover. the final season of the year is coming, while the epidemic in europe

and the us rebounds, overseas manufacturing has been blocked, however the

exports of china's manufacture are in short supply. the shipping market has

turned to be stable with the coming of heating season. shipowners have a strong

attitude of firming rates, and freight rates have been rebounded. the ship

auction market in china has obviously recovered from the previous month. there are

rare bulk carriers auctioned in the market, but engineering ship auctions are

booming. this month, the ship auction market in china has seen a total of 61

auctions and 33 transactions, with a transaction rate of 54.1%. the total starting

price is about ¥128.29m,

while the total transaction price is ¥84.73m, with all data doubled from the previous month.

the rising demand for coastal transportation has caused the ship

auction market to heat up.

with the coming of heating season,

the coal transportation demand increases

rapidly. meanwhile, the outbound of grain rises, and the deep processing

enterprises’ winter storage of raw materials begins. under the condition of the

long-short game, dry bulk market turn into a rising stage. the demand for bulk

carriers is positive, so there is not much bulk carrier to be auctioned. according

to data from www.shipbid.net1, the total ship auctions of november

are 61, which increase 29 mom and 8 yoy. among them, the bulk carrier auctions

are 17, which increase 8 mom. the chemical & tanker auctions are 3, which increase

1 mom. in terms of transaction, there are 33 ships traded, which increase 16

mom, with transaction rate of 54.1%, increasing slightly mom.

in november, the price of auction increases substantially from

last month. the total starting price is approximately ¥128.29m, which increases ¥60.26m mom but decreases

¥764.82m yoy. the total transaction price is ¥84.73m, which increases ¥48.72m mom but decreases

¥588.87m yoy.

chart1 total of ship auctions in china

chart2

total price of ship auction in china

with the construction of new infrastructure and new energy

projects, the demand for engineering ships is booming.

in

march, the standing committee of the political bureau of the central committee

emphasized to accelerate the progress of major projects and infrastructure

construction that have been clearly defined in the national plan. new

infrastructure has become an important point for china to stabilize investment

and growth, promote consumption, and develop the economy stably and orderly. digital

infrastructure such as 5g technology, industrial internet, internet of things, data

center, and clean energy infrastructure such as wind and solar energy have

brought a large amount of demand for engineering ships and large cargo ships

such as deck cargo ships. auction of grab dredger “yueguangzhougong 0106”

started at ¥320,000 and

sold at ¥1,028,000. sludge carrier “xinhui

6”, “xinhui 8” and “xinhui 18” all sold at high price. among them, the premium

rate of "xinhui 18" was 152.4%, a very high rate.

in

terms of judicial auction, there are 49 ships auctioned in november, of which

23 ships are sold, with the transaction rate of 46.9%. the total starting price

is ¥91.72m, and the total transaction

price is ¥42.21m, mostly

fishing ships, engineering ships and inland dry bulk ships. in terms of commercial

auctions, there are 12 ships auctioned, of which 10 ships are sold, with the

transaction rate of 83.3%. the total starting price is ¥36.57m, the total transaction price is ¥42.52m. in addition to the bulk carrier "xinyihai 1" and

the product oil tanker "xuyang 6", there is a number of ocean fishing

vessels sold with good price in commercial auctions.

followed are

some specific auctions. in terms of bulk carriers, the 15,000dwt offshore bulk

carrier “xinyihai 1” is auctioned at second round at ¥27.42m,

exceeding the starting price of the first round, with the premium rate of

30.5%. in terms of tankers, the 3,496dwt product

oil tanker “xuyang 6” is sold at ¥10.62m. the 934dwt product oil tanker “hengfan 7” is sold at ¥2.745m. in terms of other ships, there are 4 engineering ships traded,

all with high premium rate. there are 3 passenger ships and 12 fishing ships traded,

with a significant increase from last month.

samples of ship auctions

|

bulk carriers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

xinyihai 1

|

coastal

|

15157

|

2007

|

zhoushan

|

¥21m

|

¥27.42m

|

149

|

|

2

|

guiganghongchi

23

|

inland river

|

4000

|

2019

|

guigang

|

¥5.6m

|

¥6.38m

|

24

|

|

chemicals & tankers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

xuyang 6

|

coastal

|

3496

|

2001

|

ningbo

|

¥8m

|

¥10.62m

|

40

|

|

fishing boats

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

jinfeng 5

|

unlimited

|

-

|

1984

|

japan

|

¥0.79m

|

¥1.25m

|

88

|

|

2

|

jinfeng 6

|

unlimited

|

-

|

1983

|

japan

|

¥0.92m

|

¥1.46m

|

75

|

|

3

|

shunchang 3

|

unlimited

|

-

|

1990

|

taiwan

|

¥0.78m

|

¥1.35m

|

36

|

|

engineering ships

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

yueguangzhougong

5

|

inland river

|

-

|

1994

|

taishan

|

¥0.32m

|

¥1.028m

|

172

|

|

2

|

xinhui 18

|

coastal

|

1265

|

2010

|

ningbo

|

¥1.35m

|

¥3.41m

|

132

|

preview of ship auctions

|

bulk carriers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

|

1

|

sam lion

|

unlimited

|

57539.8

|

2012

|

korea

|

¥56.66m

|