2020年10月船舶拍卖市场评述

前三季度,中国经济实现v型反弹,增速由负转正,三季度gdp同比增长4.9%,较二季度增加1.7个百分点,呈现稳健复苏态势,在产业结构、技术含量、数字化程度、产业链内循环水平等方面也出现了明显改观。在经济复苏的同时,下游运输需求增长,海运市场表现稳中有升。在运输旺季的影响下,船东惜售情绪升温,船舶拍卖市场表现则较为冷清,本月中国船舶拍卖市场累计拍卖30艘次,成交15艘次,成交率50%,起拍价累计约6642万人民币,成交额累计3438万人民币,各项拍卖数据出现较大幅度回落。

一、运输市场行情波动,船东惜售心态增强

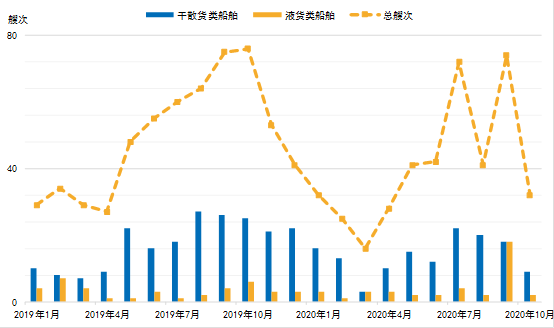

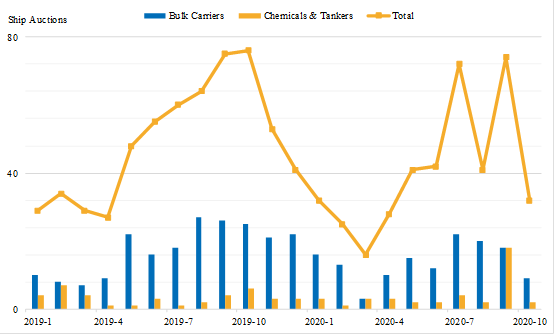

全球经济较上半年有所恢复,但复苏缓慢,国内由于疫情管控得力,运输需求持续波动,加上冬储即将来临,船期较为紧张,拍卖市场船舶数量减少。根据拍船网(www.shipbid.net)统计数据[1],10月,中国船舶拍卖市场累计拍卖32艘次,环比减少42艘次,同比减少44艘次。其中,干散货类船舶拍卖9艘次,环比减少9艘次,液货类船舶拍卖2艘次,环比减少16艘次。成交率方面,本月累计成交17艘次,环比减少26艘次,成交率为53.1%,成交率环比基本持平。

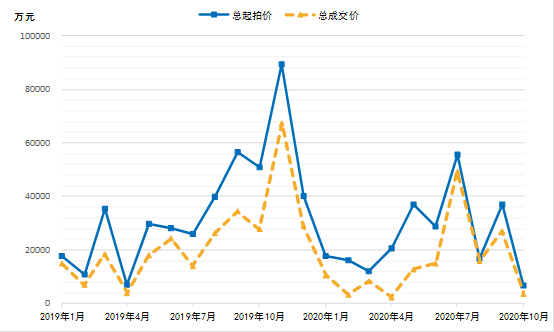

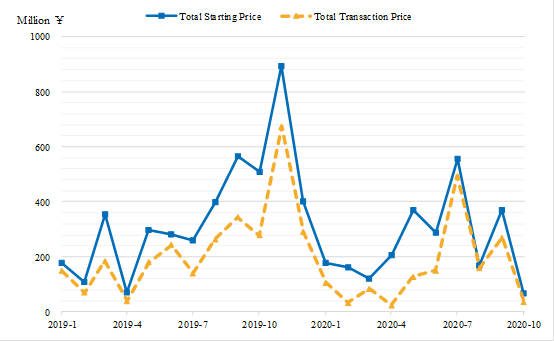

拍卖金额环比大幅下滑。10月,中国船舶拍卖市场起拍价累计约6802万人民币,环比减少30203万人民币,较上月大幅下滑,同比减少44114万人民币;成交额累计3600万人民币,环比减少23439万人民币,同比减少24167万人民币。

图1 中国船舶拍卖市场拍卖艘次情况

图2 中国船舶拍卖市场拍卖金额情况

二、船舶拍卖艘次下降,内河船舶拍卖数量增加

中国外部经济景气程度持续回升,但世界主要经济体失业率仍在较高水平,大宗商品价格震荡反弹,发达经济体货币市场利率相对稳定,新兴经济体货币市场利率走势分化,全球大宗物资需求整体仍然偏弱。中国内外贸市场则表现较为火热,铁矿石到港量持续增加,沿海煤炭运输高位波动。本月船舶拍卖市场行情则大幅回落,拍卖艘次较上月减半,海洋船舶拍卖稀少,多为内河船舶成交,成交额大幅下滑,当前船东对后市运输市场信心较足,在货多船少,运力紧张的局面下,船舶拍卖市场表现清淡。

司法拍卖方面,本月拍卖船舶27艘次,成交14艘次,成交率51.9%,起拍价总额6587万元,成交总额3353万元,多为渔船和内河干散货船成交;商业拍卖方面,本月拍卖船舶5艘次,成交3艘次,成交率60%,起拍价总额215万元,成交总额247万元,本月无大型船舶成交,量价均有所下降。

重点船舶拍卖情况,干散货船舶方面,本月未有大型海洋干散货船舶成交,多为3000-5000载重吨内河船舶成交,成交价均在200-300万左右。油运船舶拍卖同样稀少,共计成交2艘次,“恒源油6”以底价300万元成交,“金航油8”以102.6万元成交。其他船型方面,渔业用船成交4艘次,较上月增加1艘次,客滚类船舶成交1艘次,工程类船舶成交2艘次,较上月小幅减少。

「10月拍卖成交船舶案例」

|

干散货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

新一海1

|

近海

|

15157

|

2007

|

舟山

|

¥2100

|

¥2742

|

149

|

|

2

|

皖金海8389

|

内河

|

3000

|

2010

|

泰州

|

¥173

|

¥298.8

|

49

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

恒源油6

|

沿海

|

800

|

2011

|

台州

|

¥300

|

¥300

|

1

|

|

渔业用船

|

|

序号

|

船名

|

航区

|

载重量

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

琼临渔19006

|

沿海

|

-

|

2016

|

临高

|

¥361.8

|

¥424.8

|

35

|

「11月拍卖船舶预告」

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

绪扬6

|

近海

|

3496

|

2001

|

宁波

|

¥800

|

|

2

|

神州3529

|

内河

|

5600

|

2014

|

重庆

|

¥1713

|

[1]数据来源于各大拍卖平台、产权交易所公开竞价平台、船舶交易所公开竞价平台等,或有少量现场拍卖因公开程度有限可能未纳入统计

monthly

analysis of ship auction market in china

october

2020

in the first three quarters of this year, china's economy has

achieved a v-shaped rebound, turning positive from negative. in the third

quarter, gdp grew by 4.9% yoy, which increased 1.7% than that of the second

quarter, showing a steady recovery trend. significant improvements have been

made in industrial structure, technological content, digitalization degree, and

internal cycle of industrial chain.while the

economy is recovering, downstream transportation demand has also grown and the

maritime market rises steadily. under the peak season of the transport,

shipowners are reluctant to sell ships, and the ship auction market is

relatively quiet. this month, the ship auction market in china has seen a total

of 30 auctions and 15 transactions, with a transaction rate of 50%. the total starting

price is about ¥66.42m,

while the total transaction price is ¥34.38m. the data showed a significant drop.

the transportation market fluctuates at a high level, and the

shipowners are reluctant to sell.

the global economy has recovered from the first half of the year slightly

and slowly. but due to the effective epidemic control measure in china, the

domestic transportation demand continues to fluctuate at a high level. in

addition, the time of winter storage is coming, shipping schedule is tight, and

the number of ships in the auction market has decreased. according

to data from www.shipbid.net1, the total ship auctions of october

are 32,which

decrease 42 mom and 44 yoy. among them, the bulk carrier auctions are 9, which decrease

9 mom. the chemical & tanker auctions are 2, which decrease 16 mom. in terms

of transaction, there are 17 ships traded in october, which decrease 26 mom,

with transaction rate of 53.1%, similar as last month.

in october, the price of auction drops sharply from last month. the

total starting price is approximately ¥68.02m, with a

significant decrease of ¥302.03m mom and decreases ¥441.14m yoy. the

total transaction price is ¥36.00m, which decreases ¥234.39m mom and ¥241.67m yoy.

chart1 total of ship auctions in china

chart2

total price of ship auction in china

the number of ship auctions decreased, but that of inland watweway

ship auctions increased.

the

external economic prosperity of china continues to rebound, but the

unemployment rate of other major economies in the world is still at a

relatively high level. the overall global demand for bulk cargos remains weak

because that the commodity prices rebounds with fluctuation, the interest rates

of money market in developed economies are relatively stable while that in

emerging economies diverges. china's domestic and foreign trade markets are now

in full swing, the volume of iron ore arriving at ports continues to increase,

and coastal coal transport fluctuates at a high level. this month, the ship

auction market has fallen sharply, with auctions of all ships halved compared

with that of the previous month. among them, sea ship auctions are rare, most

of which are inland ships with sharply dropped transaction price. nowadays,

shipowners are relatively confident in the future transportation market. because

of the tight transportation capacity, the ship auction market has been weak.

in

terms of judicial auction, there are 27 ships auctioned in october, of which 14

ships are sold, with the transaction rate of 51.9%. the total starting price is

¥65.87m, and the total transaction

price is ¥33.53m, mostly

fishing ships and inland dry bulk ships. in terms of commercial auctions, there

are 5 ships auctioned, of which 3 ships are sold, with the transaction rate of 60%.

the total starting price is ¥2.15m, the total transaction price is ¥2.47m. there is no large-scale ship auctioned this month, with decline

in both number and price.

followed are

some specific auctions. in terms of bulk carriers, there is no large-scale ship auctioned this month.most of the

transaction are inland ships of 3,000-5,000dwt with transaction price from ¥2.00m to ¥3.00m.

the auctions of tankers are also rare, with a total number of 2. "hengyuanyou

6" is sold at a reserve price of ¥3.00m, and "jinhangyou 8" is sold at ¥1.026m. in terms of other ships, there are 4 fishing

ships traded, an increase of 1 from last

month. there is 1 passenger ship and 2 engineering ships traded, a slightly decrease

from last month.

samples of ship auctions

|

bulk carriers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

xinyihai 1

|

coastal

|

15157

|

2007

|

zhoushan

|

¥21m

|

¥27.42m

|

149

|

|

2

|

wanjinhai 8389

|

inland river

|

3000

|

2010

|

taizhou

|

¥1.73m

|

¥2.99m

|

49

|

|

chemicals & tankers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

hengyuanyou 6

|

coastal

|

800

|

2011

|

taizhou

|

¥3.0m

|

¥3.0m

|

1

|

|

fishing boats

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

transaction

price

|

bids

|

|

1

|

qionglinyu

19006

|

coastal

|

-

|

2016

|

lingao

|

¥3.62m

|

¥4.25m

|

35

|

preview of ship auctions

|

chemicals & tankers

|

|

no.

|

ship

name

|

sailing

area

|

dwt

|

year

built

|

shipyard

|

starting

price

|

|

1

|

xuyang 6

|

coastal

|

3496

|

2001

|

ningbo

|

¥8.0m

|

|

2

|

shenzhou 3529

|

inland river

|

5600

|

2014

|

chongqi

|

¥17.13m

|