2021年9月船舶拍卖市场评述

9月,“秋老虎”天气影响逐渐消退,沿海各地高温天气得到缓解,居民用电量有所回落,但在工业用电需求支撑下,电厂日耗小幅下滑后仍处高位。煤炭价格较高,下游补库操作较为谨慎,沿海电厂库存几乎都处于红线状态,受刚需拉动,本月沿海运价先抑后扬。国际市场方面,集装箱市场高位盘整,散货运输市场运价不断冲高,船东信心充足,但市场可售运力有限,船价处于高位。总体来看,中国船舶拍卖市场累计拍卖73艘次,成交37艘次,成交率50.7%,起拍价累计约114517万人民币,成交额累计95893万人民币,船舶拍卖量较上月大幅增长。

一、受国内运输市场刚需推动,船舶拍卖市场热情再度冲高

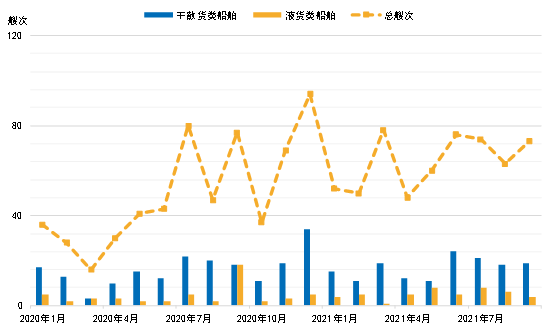

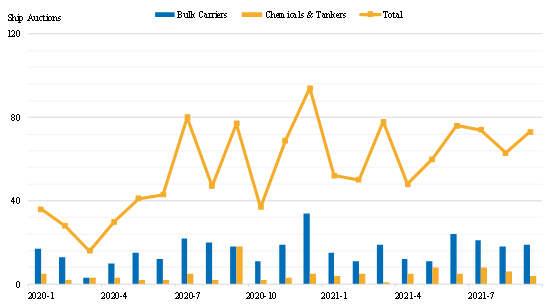

9月,受多个台风影响,市场运力较为紧张,国内市场运价较前期有所提振,船东信心重燃。根据拍船网(www.shipbid.net)统计数据,9月,中国船舶拍卖市场累计拍卖73艘次,环比增加10艘次,同比减少4艘次。其中,干散货类船舶拍卖19艘次,环比增加1艘次,液货类船舶拍卖4艘次,环比减少2艘次。成交率方面,本月累计成交37艘次,环比减少2艘次,成交率为50.7%,成交率环比有所下滑。

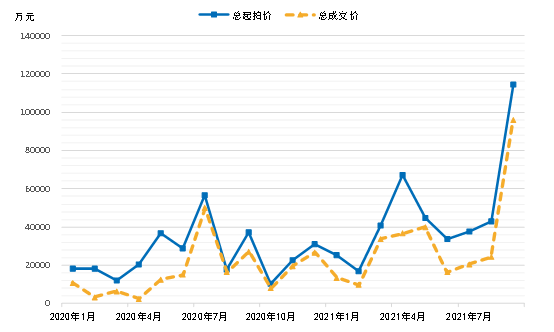

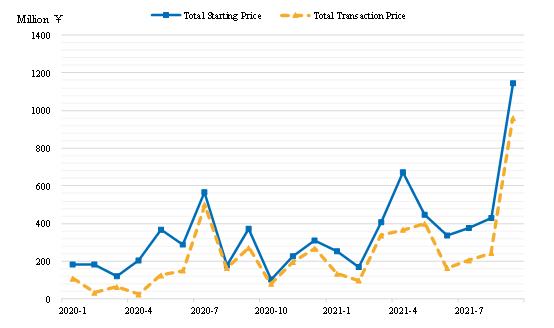

拍卖成交额大幅上涨。9月,中国船舶拍卖市场起拍价累计114517万人民币,环比增加71693万人民币,同比增加77439万人民币;成交额累计95893万人民币,环比增加71614万人民币,同比增加68763万人民币。

图1 中国船舶拍卖市场拍卖艘次情况

图2 中国船舶拍卖市场拍卖金额情况

二、沿海运输市场行情稳中带涨,国际运输市场热度继续上扬

国际干散货市场各船型表现各异,海岬型船市场受台风“灿都”影响以及货盘支撑下,运价大幅上涨,波罗的海交易所数据显示,bci在一个月内由6000点冲至9000点,而巴拿马型船和超灵便型船货盘则略显不足,活跃度不高,运价小幅波动。沿海运输市场在9月上半月表现较为冷清,运价接连下滑,步入9月下旬后,在电厂煤炭拉运刚需的推动下,运价快速回涨。

司法拍卖方面,本月拍卖船舶38艘次,成交15艘次,起拍价总额35608万元,成交总额9495万元;商业拍卖方面,本月拍卖船舶35艘次,成交22艘次,起拍价总额78910万元,成交总额86398万元。本月商业拍卖成交多艘大型船舶,成交额大幅上扬。

重点船舶拍卖情况,本月干散货船成交较多,重点船舶方面,“华融1”以12410万人民币成交,“b85k-9”在建船舶以3603万美元成交,“josco suzhou”以1350万美元成交,“seacon 6”以1530万美元成交。油船成交较少,多为内河小型油船。其他船型方面,渔业用船成交3艘次,成交额591万人民币,工程类船舶成交10艘次,3655万人民币,客滚类船舶未有成交。

「拍卖成交船舶案例」

|

干散货类船舶

|

|

序号

|

船名

|

航区

|

dwt/参考载货量

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

华融1

|

无限

|

56381

|

2012

|

浙江

|

¥9500

|

¥12410

|

115

|

|

2

|

“b85k-9”在建船舶

|

无限

|

约85000

|

2022

|

辽宁

|

$3018

|

$3603

|

36

|

|

3

|

josco suzhou |

无限

|

49416

|

2004

|

江苏

|

$870

|

$1350

|

26

|

|

4

|

shao shan 5

|

无限

|

75449.3

|

2012

|

广东

|

$1500

|

$2082

|

45

|

|

5

|

shao shan 6

|

无限

|

75416

|

2012

|

广东

|

$1500

|

$2090

|

45

|

|

6

|

成路1

|

近海

|

7900

|

2006

|

浙江

|

¥1170.56

|

¥1170.56

|

1

|

|

7

|

seacon 6

|

无限

|

56826

|

2012

|

浙江

|

$1480

|

$1530

|

8

|

「拍卖船舶预告」

|

干散类船舶

|

|

序号

|

船名

|

航区

|

dwt/参考载货量

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

山东海昌

|

无限

|

75081

|

2011

|

山东

|

$1623

|

|

2

|

北仑海9

|

无限

|

约65000

|

1989

|

日本

|

¥1850

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

dwt/参考载货量

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

鑫通宇8

|

沿海

|

3357

|

2005

|

浙江

|

¥785

|

|

2

|

鑫通宇18

|

沿海

|

2570

|

2006

|

浙江

|

¥635

|

monthly analysis of ship auction market in china

september 2021

in september, with the autumn heatwaves gradually subsided, high temperature in coastal areas was relieved, and the electricity consumption of residents has dropped. however, demand for industrial electricity is still strong, and daily consumption of power plants remains high after a small decline. for the high coal price, power plants are cautious in replenishment which makes almost all coastal power plants' inventories under the red line. the freight rate of coastal dry bulk transportation rises for strong demands in late september. in the international market, the freight rate of container is fluctuating at an extremely high level, while which in dry bulk market continues to rise. shipowners have sufficient confidence, so there is fewer ship on sale with high price. there are 73 ships auctioned in september and 37 are sold with transaction rate of 50.7%. the total starting price is about ¥1145.17m, while the total transaction price is ¥958.93m, increasing significantly.

rigid demand in the domestic transportation market have brought massive push to the ship auction market.

during the september, affected by a number of typhoons, transport capacity in china is tight, and the freight rate is boosted compared to previous period which rekindles shipowners' confidence. according to data from shipbid.net, in china, the total ship auctions of september are 73, which increase 10 mom but decrease 4 yoy. among them, bulk carriers are 19, which increase 1 mom and chemical & tankers are 4, which decrease 2 mom. in terms of transaction, there are 37 ships sold, which decrease 2 mom, with transaction rate of 50.7%, decreasing from last month.

in september, price of ship auction increases sharply. the total starting price is approximately ¥1145.17m, which increases ¥716.93m mom and ¥774.39m yoy. the total transaction price is ¥958.93m, which increases ¥716.14m mom and¥687.63m yoy.

chart1 total of ship auctions in china

chart2 total price of ship auction in china

the coastal transportation market is steadily rising, and the international transportation market continues to heat up.

the performance of international dry bulk market is different in each ship type. the capesize, affected by the typhoon "chanthu" and strong activities, provides a sharp rise of freight rate. according to data from the baltic exchange, bci rushes from 6000 points to 9000 points within a month, while activities of panamax and supramax are slightly insufficient, and the freight rate fluctuates slightly. the coastal transportation market is relatively quiet in the early september, with freight rates falling successively. while in the late september, driven by rigid demand for coal of power plants, freight rates rebounded rapidly.

in terms of judicial auction, there are 38 ships auctioned in september, of which 15 are sold. the total starting price is ¥356.08m, and the total transaction price is ¥94.95m. in terms of commercial auctions, there are 35 ships auctioned, of which 22 are sold. the total starting price is ¥789.10m, the total transaction price is ¥863.98m. a number of large-scale ships are sold at commercial auctions in september, with transaction price rising sharply.

followed are some specific auctions, mostly bulk carriers. the “hua rong 1” sold at ¥124.10m; “b85k-9”, bulk carrier under construction, sold at $36.03m; “josco suzhou” sold at $13.50m; “seacon 6” sold at $15.30m. meanwhile, there are fewer tankers traded in september, of which are mostly small -tonnage inland river tankers. in terms of other ships, there are 3 fishery ships sold with the total price of ¥5.91m, 10 engineering ships sold with the total price of ¥36.55m and no ro-ro passenger ship sold.

samples of ship auctions

|

bulk carriers

|

|

no.

|

ship name

|

sailing area

|

dwt/

reference capacity

|

year built

|

shipyard

|

starting price

|

transaction price

|

bids

|

|

1

|

huarong 1

|

unrestricted navigation

|

56381

|

2012

|

zhejiang

|

¥95m

|

¥124.1m

|

115

|

|

2

|

hull b85k-9

|

unrestricted navigation

|

85000

|

2022

|

liaoning

|

$30.18m

|

$36.03m

|

36

|

|

3

|

josco suzhou

|

unrestricted navigation

|

49416

|

2004

|

jiangsu

|

$8.7m

|

$13.5m

|

26

|

|

4

|

shao shan 5

|

unrestricted navigation

|

75449.3

|

2012

|

guangdong

|

$15m

|

$20.82m

|

45

|

|

5

|

shao shan 6

|

unrestricted navigation

|

75416

|

2012

|

guangdong

|

$15m

|

$20.9m

|

45

|

|

6

|

chenglu 1

|

coastal

|

7900

|

2006

|

zhejiang

|

¥11.71m

|

¥11.71m

|

1

|

|

7

|

seacon 6

|

unrestricted navigation

|

56826

|

2012

|

zhejiang

|

$14.8m

|

$15.3m

|

8

|

preview of ship auctions

|

bulk carriers

|

|

no.

|

ship name

|

sailing area

|

dwt/

reference capacity

|

year built

|

shipyard

|

starting price

|

|

1

|

shandonghaichang

|

unrestricted navigation

|

75081

|

2011

|

shandong

|

$16.23m

|

|

2

|

beilunhai 9

|

unrestricted navigation

|

65000

|

1989

|

japan

|

¥18.5m

|

|

chemicals & tankers

|

|

no.

|

ship name

|

sailing area

|

dwt/

reference capacity

|

year built

|

shipyard

|

starting price

|

|

1

|

xintongyu 8

|

coastal

|

3357

|

2005

|

zhejiang

|

¥7.85m

|

|

2

|

xintongyu 18

|

coastal

|

2570

|

2006

|

zhejiang

|

¥6.35m

|