2021年1月船舶拍卖市场评述

1月,农历春节临近,传统“春节”效应逐步显现,户外建工企业停工数量增加,部分工厂、服务业开始陆续放假,工业用电高负荷状态有所缓解,电厂库存消耗放缓,煤炭现货价格出现回调,叠加局部地区疫情影响,大宗商品需求有所减弱,运价开始下跌,沿海煤炭运价已从月初的高位跌至保本线。船舶拍卖市场随着运输市场行情走弱,春节前夕拍卖项目减少。本月中国船舶拍卖市场累计拍卖52艘次,成交19艘次,成交率36.5%,起拍价累计约22947万人民币,成交额累计13578万人民币,年初各项拍卖数据有所回落。

一、沿海运价回调,船舶拍卖市场有所降温

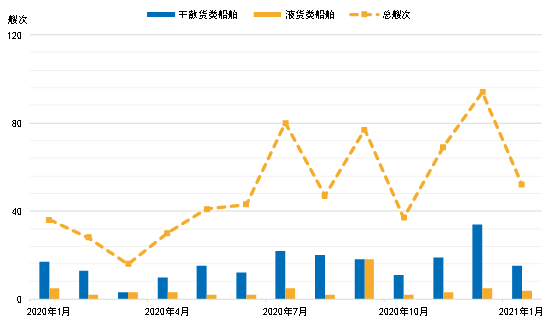

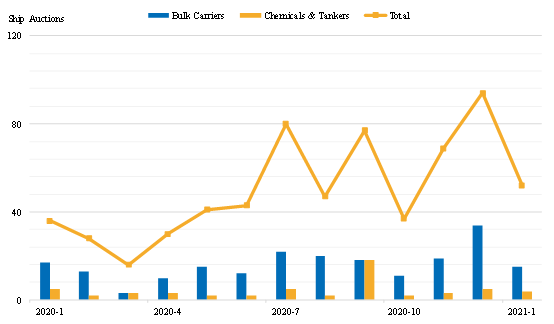

沿海运输市场货盘成交逐步减弱,运力供大于求现象明显,运价进入下行通道。根据拍船网(www.shipbid.net)统计数据,1月,中国船舶拍卖市场累计拍卖52艘次,环比减少42艘次,同比增加16艘次。其中,干散货类船舶拍卖15艘次,环比减少19艘次,液货类船舶拍卖4艘次,环比减少1艘次。成交率方面,本月累计成交19艘次,环比减少35艘次,成交率为36.5%,成交率环比有所下滑。

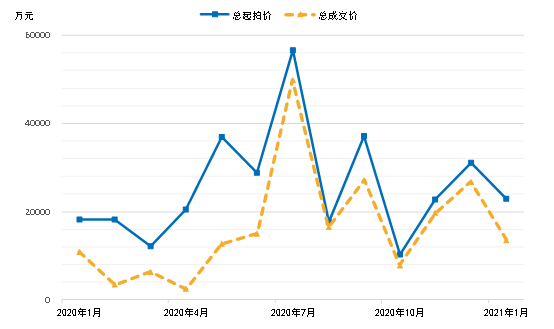

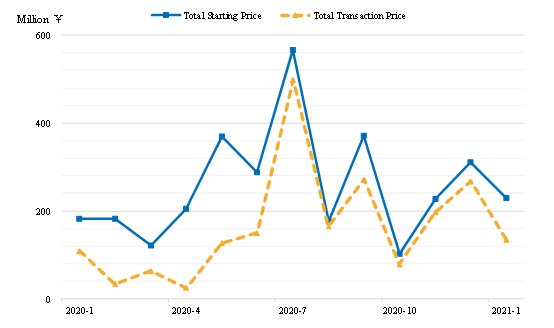

拍卖金额环比有所下降。1月,中国船舶拍卖市场起拍价累计约22947万人民币,环比减少8130万人民币,同比增加4637万人民币;成交额累计13578万人民币,环比减少13236万人民币,同比增加2687万人民币。

图1 中国船舶拍卖市场拍卖艘次情况

图2 中国船舶拍卖市场拍卖金额情况

二、中国传统春节临近,沿海各类船型需求减弱

煤炭市场逐步降温,钢材市场窄幅震荡,现货市场成交停滞,由于原材料成本较高,钢厂减产数量增多,下游需求表现不佳,运输市场降温,船东观望情绪加重。本月鲜有大型船舶成交,“明州20”散货船以3550万元成交,“海之星998”油船以6502.2万元成交,前期较为火爆的挖泥船、甲板货船拍卖项目减少,但本月采砂船、自卸砂船成交相对较多,且溢价率较高,“粤广海货9897”自卸砂船以117.4万元成交,溢价率45.8%,“顺洋3366”自卸砂船以391万元成交,溢价率255.5%。

司法拍卖方面,本月拍卖船舶39艘次,成交16艘次,起拍价总额10571万元,成交总额9544万元;商业拍卖方面,本月拍卖船舶13艘次,成交3艘次,起拍价总额12377万元,成交总额4033万元。本月司法拍卖和商业拍卖项目均不及上月,春节前夕上拍项目减少。

重点船舶拍卖情况,干散货船舶方面,“明州20”6.5万载重吨散货船以3550万元成交,溢价率69.7%。油运船舶方面,“海之星998”万吨级油船以6502.2万元成交。其他船型方面,工程类船舶成交4艘次,客滚类船舶成交1艘次,渔业用船成交6艘次。

「拍卖成交船舶案例」

|

干散货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

明州20

|

-

|

64827

|

1988

|

韩国

|

¥2092

|

¥3550

|

17

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

海之星998

|

近海

|

10500

|

2013

|

浙江

|

¥3482.2

|

¥6502.2

|

277

|

|

工程类船舶

|

|

序号

|

船名

|

航区

|

载重量

|

建造年份

|

造船厂

|

起拍价

万元

|

成交价

万元

|

出价次数

|

|

1

|

顺洋3366

|

内河

|

-

|

2005

|

广东

|

¥110

|

¥391

|

117

|

「拍卖船舶预告」

|

干散类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

zhongyu 89

|

无限

|

55000

|

2010

|

江苏

|

$698

|

|

2

|

老船长7

|

近海

|

16361

|

2009

|

江苏

|

¥908.8

|

|

液货类船舶

|

|

序号

|

船名

|

航区

|

载重吨

|

建造年份

|

造船厂

|

起拍价

万元

|

|

1

|

乾坤化001

|

内河

|

1500

|

2009

|

江苏

|

¥335

|

|

2

|

乾坤化002

|

内河

|

1500

|

2009

|

江苏

|

¥346

|

monthly analysis of ship auction market

january 2021

in january, the spring festival of china is approaching which brings impact on all walks of life. the outdoor construction companies, factories and service industries continue to close which has eased the high load of industrial power consumption. with power plant inventory consumption slow down, and coal spot price fall, the demand for bulk commodities has weakened together with the freight rate falls. with the impact of the epidemic in some areas, the coastal coal freight rate has fallen from the high level at the beginning of january to the break-even price. the ship auction market is getting slow with less objects for the quiet shipping market before the festival . this month, the ship auction market in china has seen a total of 52 auctions and 19 transactions, with a transaction rate of 36.5%. the total starting price was about ¥229.47m, while the total transaction price was ¥135.78m, with all data declined from the beginning of year 2021.

the coastal freight rate falls, while the ship auction market has been slow down.

new requirement of coastal transport market has gradually weakened, while the supply of capacity has clearly exceeded demand which make the freight rates in the downward channel. according to data from www.shipbid.net1, the total ship auctions of january are 52, which decrease 42 mom but increase 16 yoy. among them, the bulk carrier auctions are 15, which decrease 19 mom. the chemical & tanker auctions are 4, which decrease 1 mom. in terms of transaction, there are 19 ships traded, which decrease 35 mom, with transaction rate of 36.5%, decreasing slightly mom.

in january, the price of ship auction has slightly decreased from last month. the total starting price is approximately ¥229.47m, which decreases ¥81.30m mom but increases ¥46.37m yoy. the total transaction price is ¥135.78m, which decreases ¥132.36m mom but increases ¥26.87m yoy.

chart1 total of ship auctions in china

chart2 total price of ship auction in china

with the spring festival approaching, the demand for various types of coastal ships is weakening.

the spot market has stagnated with coal market gradually cooled down and the steel market fluctuated within a narrow range. due to the high price of raw materials, there are more steel mills reducing production which make the downstream demand negative. for the transportation market cooling down, the wait-and-see sentiment of shipowners is increasing. this month has seen few transactions of large scale ship auctions. the bulk carrier “mingzhou 20” is sold at ¥35.50m, and the tanker “haizhixing 998” is sold at ¥65.022m. the auction objects of dredger and deck cargo ship which used to be relatively popular have now decreased. in january, the transaction of sand dredgers and self-unloading sand carriers was relatively good with high premium rate. the self-unloading sand carriers “yueguanghaihuo 9897” is sold at ¥1.174m, with premium rate of 45.8%. the self-unloading sand carriers “shunyang 3366” is sold at ¥3.91m, with premium rate of 255.5%.

in terms of judicial auction, there are 39 ships auctioned in january, of which 16 ships are sold. the total starting price is ¥105.71m, and the total transaction price is ¥95.44m. in terms of commercial auctions, there are 13 ships auctioned, of which 3 ships are sold. the total starting price is ¥123.77m, the total transaction price is ¥40.33m. both judicial auctions and commercial auctions are less than last month, and there are fewer auctions before the spring festival.

followed are some specific auctions. in terms of bulk carriers, the 65,000dwt bulk carrier “mingzhou 20” is sold at ¥35.50m, with premium rate of 69.7%. in terms of tankers, the “haizhixing 998” is sold at ¥65.022m. in terms of other ships, there are 4 engineering ships, 1 passenger ship and 6 fishing ships traded in january.

samples of ship auctions

|

bulk carriers

|

|

no.

|

ship name

|

sailing area

|

dwt

|

year built

|

shipyard

|

starting price

|

transaction price

|

bids

|

|

1

|

mingzhou 20

|

-

|

64827

|

1988

|

korea

|

¥20.92m

|

¥35.5m

|

17

|

|

chemicals & tankers

|

|

no.

|

ship name

|

sailing area

|

dwt

|

year built

|

shipyard

|

starting price

|

transaction price

|

bids

|

|

1

|

haizhixing 998

|

coastal

|

10500

|

2013

|

zhejiang

|

¥34.82m

|

¥65.02m

|

277

|

|

engineering ships

|

|

no.

|

ship name

|

sailing area

|

dwt

|

year built

|

shipyard

|

starting price

|

transaction price

|

bids

|

|

1

|

shunyang 3366

|

inland river

|

-

|

2005

|

guangdong

|

¥1.1m

|

¥3.91m

|

117

|

preview of ship auctions

|

bulk carriers

|

|

no.

|

ship name

|

sailing area

|

dwt

|

year built

|

shipyard

|

starting price

|

|

1

|

zhongyu 89

|

unrestricted navigation

|

55000

|

2010

|

jiangsu

|

$6.98m

|

|

2

|

laochuanzhang 7

|

coastal

|

16361

|

2009

|

jiangsu

|

¥9.088m

|

|

chemicals & tankers

|

|

no.

|

ship name

|

sailing area

|

dwt

|

year built

|

shipyard

|

starting price

|

|

1

|

qiankunhua 001

|

inland river

|

1500

|

2009

|

jiangsu

|

¥3.35m

|

|

2

|

qiankunhua 002

|

inland river

|

1500

|

2009

|

jiangsu

|

¥3.46m

|